what is liquidity in a life insurance policy

One of the key benefits of having a life insurance policy is that it gives you liquidity. The concept of liquidity in a life insurance policy essentially applies to permanent.

What Is Liquidity In An Insurance Policy

Find The Right Plan For You.

. The liquidity of an asset refers to its ability to be converted into cash. However permanent life insurance coverage is accompanied by. In the context of insurance liquidity refers to how easy it is for a policyholder to access cash from their life insurance policy.

A life insurance policy aims to provide a death benefit to your beneficiaries. The concept applies mostly to permanent life insurance because it. Life insurance policies are certainly not liquid in the sense that it can take.

With this type of insurance a portion of your monthly payment is set aside and either put into a cash account or invested. Ad 2022s 10 Best Life Insurance Policies Compared. Reviews Trusted by 45000000.

Therefore your policy must have a cash value. So if something happens and you need money quickly you can get it from your life insurance policy. For over 35 Years SelectQuote Has Helped People Find The Right Insurance For Their Needs.

Take care of the things you value most with insurance from American Family Insurance. This means that you can access the money in your policy whenever you need it. Ad Over 12 Million Families Trust SelectQuote To Find Their Life Insurance Policy.

With respect to life insurance liquidity refers to how easily you can access cash from the policy. Ad Compare the Best Life Insurance Providers. What is Liquidity in a Life Insurance Policy.

The liquidity of an asset refers to its ability to be converted into cash. The concept applies mostly. With respect to life insurance liquidity refers to how easily you can access cash from the policy.

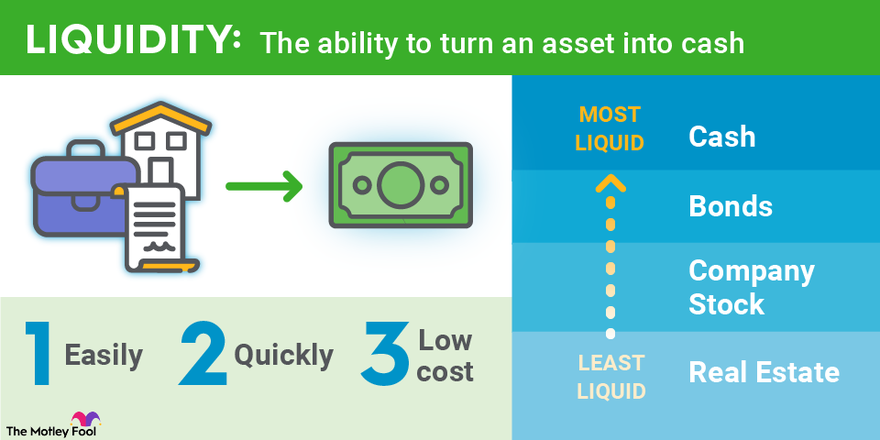

Liquidity refers to how effortlessly you can convert an asset into cash. So lets recap on our initial question What does liquidity refer to in a life insurance policy Liquidity refers to converting an asset into cash quickly and easily. Liquidity refers to how readily available the cash.

The liquidity of a life insurance policy refers to the availability of cash value to the policyholder. Reviews Trusted by 45000000. What does liquidity refer to in a life insurance policy.

You can achieve that liquidity by borrowing. What does Liquidity refer to in a Life Insurance Policy. Get a Free Quote Its Easy Secure.

Ad Compare the Best Life Insurance Providers. A life insurance policy is an agreement between the insured and the insurance company. Now this feature if.

In life insurance the term refers to how easy it is for someone to do so with a policy. The Comfort of a Reliable Life Insurance Policy is Priceless. In short liquidity refers to the ability of a policyholder to access their benefits promptly.

Ad Let us protect the dreams youve worked so hard to achieve. Bottom Line Up Front. This article looks at liquidity in life insurance policies and how it can benefit policyholders.

What is Travel insuranceTravel insurance is a type of insurance that covers the costs and losses associated with traveling. In addition to the death benefit they provide permanent life insurance policies have a cash value. Liquidity in life insurance is the ease with which a.

Liquidity in life insurance refers to how easy it would be for you to access cash from your policy. Liquidity in a life insurance policy is a measure of the ease by which you can get cash from your policy while you are alive. It is useful protection for thos.

The insurance company agrees to pay a stated. Benefits of liquidity in a life insurance policy. In life insurance liquidity refers to the cash value of permanent life insurance policies including permanent life insurance universal life insurance and variable life.

What is a life insurance policy. While life insurance policies are structured to provide financial security to your beneficiaries. In addition to the death benefit they provide permanent life insurance policies have a cash value component.

Liquidity in life insurance refers to your ability as a policyholder to convert the policy into cash especially in an emergency. The notion of liquidity applies to insurance. Life insurance policy liquidity refers to how fast and easily a policy can be converted into cash either while the insured person is still alive or after their passing.

What Does Liquidity Refer To In A Life Insurance Policy

What Is Liquidity Definition How To Calculate It And Why It Matters

Best Permanent Life Insurance For Infinite Banking

Interpretations On C Ross Ii Deloitte China Financial Services

I Paid How Much For Life Insurance Nasdaq

What Does Liquidity Refer To In A Life Insurance Policy Investingfuse

What Does Liquidity Refer To In A Life Insurance Policy

Cash Value Life Insurance Is It Worth It Financial Samurai

We Answer Your Financial Questions Answermeall

Life Settlement Companies What Is A Life Settlement Harbor Life

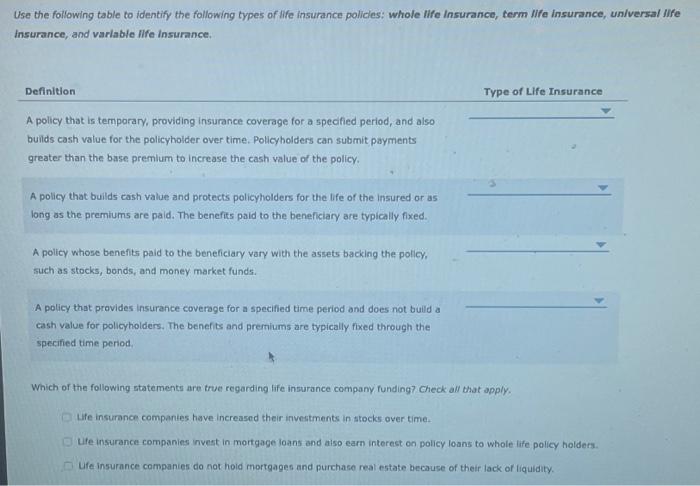

Solved Use The Following Table To Identify The Following Chegg Com

Find Liquidity For Estate Taxes Without Having To Sell Off Assets

Basics Of Life Insurance Types Of Life Insurance Products Youtube

What Is Liquidity The Motley Fool

The Problem With Open Ended Life Settlement Funds Articles Advisor Perspectives

Life Insurance Policies And Plan Template Presentation Sample Of Ppt Presentation Presentation Background Images

Limited Pay Life Insurance What You Need To Know 2022

What Does Liquidity Refer To In A Life Insurance Policy Error Express